What Is a Car Insurance Premium?

Getting a new car can be an exciting experience, but before you can get behind the wheel there are a few things to think about - one of the biggest being insurance. But what is a premium in car insurance exactly, and why does it matter?

Read time

6 minutes

Date

08.24.2023

Share

Getting a new car can be an exciting experience, but before you can get behind the wheel there are a few things to think about - one of the biggest being insurance. But what is a premium in car insurance exactly, and why does it matter?

Vehicle insurance is not only useful for protecting you financially against any potential mishaps, it’s also a legal requirement in nearly every corner of the United States. Because of this, insurance means drivers are also subject to car insurance premiums - regular payments for your coverage.

But for those who would rather not have to think about car insurance premiums, a FINN car subscription could be the ideal alternative. With FINN, your car’s insurance is included in the subscription package, including a $1,000 deductible so you can have the confidence to roam without having to worry. And considering a FINN subscription also includes vehicle maintenance, registration, and roadside assistance, your car will be ready to go when you are.

Find your car

What is a car insurance premium?

A car insurance premium is the amount you pay to an insurer for coverage in case your vehicle is involved in an accident. Whether you lease or buy your car, you will almost certainly need some form of insurance coverage.

Premiums can be paid either monthly, every six months, or annually. However often you pay, the total premium will vary based on a number of factors.

When setting car insurance premiums, insurers will typically consider a vehicle owner’s driving record, the type of car they have, and even where they live. Simply put, insurers consider many risk factors and then offer you an insurance premium they consider appropriate.

What is a car insurance premium vs. a deductible?

Car insurance premiums are the regular payments you make to an insurance company. The purpose of these payments is to provide adequate coverage should anything go wrong while you're on the road. In most instances, insurance covers some level of property damage and personal injury costs, though policies will vary from insurer to insurer and driver to driver.

A deductible is the money you must pay before your insurer will cover a claim. Some insurers may offer you a higher deductible in exchange for a lower premium, but you should always be prepared for that out-of-pocket cost should a claim be filed. As with insurance premiums, there can be a broad variation in deductibles from insurer to insurer, and even from plan to plan.

As someone considering various insurance plans, it’s smart to make yourself fully aware of the premiums and deductibles before you settle on a vehicle policy.

What is an insurance quote vs. a car insurance premium?

An insurance quote is an estimated figure that is presented to you when you make an insurance inquiry. Insurers will usually present you with a quote for the total cost, but if you opt not to take it at that time, there is always a chance that the number could change.

How to shop around for car insurance quotes

Because insurance rates can vary across providers, it is important to look into what each one offers and what they will charge for both premiums and deductibles.

Some people like to use price comparison websites when researching their car insurance options, while others may find it easier to create their own custom spreadsheet. Either way, settle on what works best for you.

FINN’s subscription offering is a great alternative for those who prefer not having to shop around for car insurance. Whether you’re on a six or 12 month term, insurance, maintenance, and roadside assistance are all included in one monthly price.

What is the average car insurance premium?

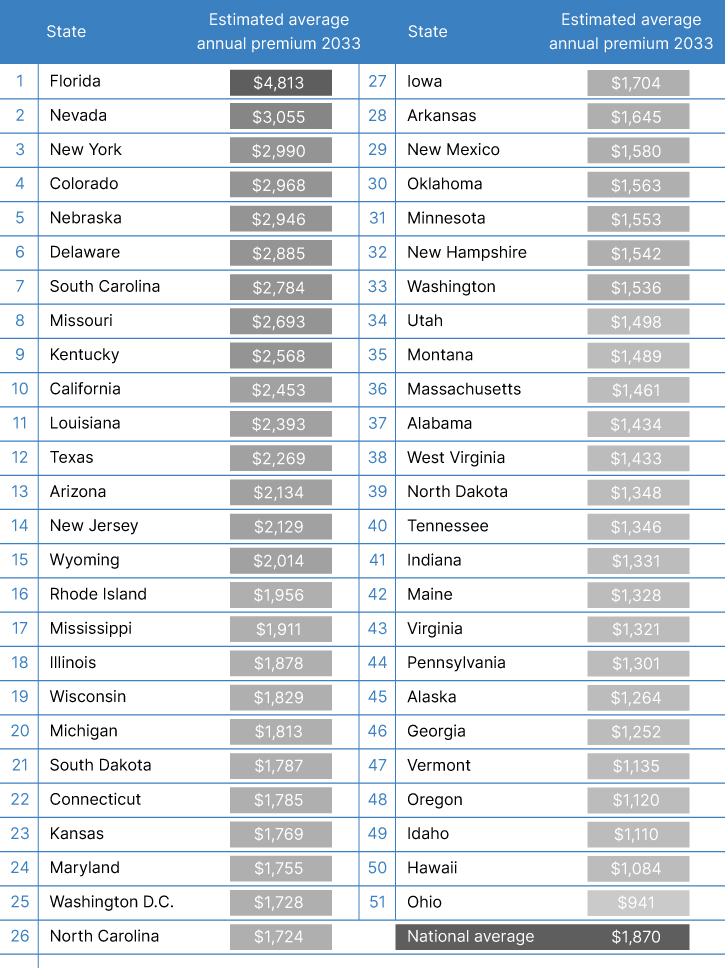

Car insurance rates can vary significantly across the states, and your total policy premium will very much depend on your driving history as well as the car you are insuring. However, an aggregate of car insurance rates for the United States as a whole shows that the average premium costs a little over $2,000 a year.

If you want to better understand the costs for your state, this table shows the average for full-coverage insurance premiums across all 50 states and Washington D.C.

How to calculate car insurance premium

Car insurance companies will weigh up many factors when calculating your premiums. These include the state and city in which you live, your gender and age, as well as your current credit score and driving record. They will also want to know about your vehicle type, its age, and what kind of deductible you are looking for. An insurer will likely also ask if you wish to add another driver to your plan, and then some questions about their driving history.

An online car insurance calculator can help you build an estimate of what you might expect to pay for your premium.

An example quote for a 45-year-old woman living in Jersey City, NJ, with a clean driving record who will be the sole driver of an SUV that is less than three years old can expect to pay as much as $1,316 annually with a $1,000 deductible.

Of course, it’s worth remembering that this is just an estimate, and that every driver will have different circumstances. For instance, if this Jersey City driver decided she wanted to take an extended trip in six months time, she would want to ask a prospective insurer whether she would be able to pause her policy. If it’s not possible, then she may find a FINN six-month subscription better fits her needs.

How to save on car insurance premiums

While car premiums are set by insurance companies, there are some ways you can try to bring them down. Here are some things to consider:

- Compile and compare quotes from multiple insurers.

- Consider opting for a larger deductible.

- Enquire about any discounts that may be available to you.

- Explore the prospect of purchasing your home and car insurance from the same company. Many offer bundle discounts.

Premium in car insurance FAQs

What does a six month premium mean?

A six month premium refers to the amount of time that you will have insurance coverage for your vehicle. Once that six month period is over, you will have to replace it with a new policy if you plan to keep your car on the road.

When do automobile insurance premiums increase?

Insurance premiums change when your insurer reassesses the risks associated with your coverage. Premiums can go up based on a number of factors, including if you have swapped to a new car. With FINN’s upfront subscription pricing, it’s easy to know how much your vehicle will cost each month because everything is bundled into a single price.

How do you pay a car insurance premium?

Payment methods may vary from insurer to insurer, but typically speaking you can pay your car insurance premium via credit card, check, or electronic transfer. Make sure you are clear on the payment terms and processes when you take out a policy.

What happens if you do not pay your car insurance premium?

There are many possible consequences for not paying your insurance premium, not least of which is that your policy may lapse. This means that you will not have adequate vehicle insurance, and therefore should not drive your vehicle on public roads. It is best to always discuss any payment issues with your premium provider to avoid such issues.

Final thoughts

Car insurance premiums are important for not only you and your vehicle, but also others on the road. Of course, because of the variation across premiums, selecting the right plan may require significant consideration. Some may even wonder if there is a better solution for their needs.

A FINN subscription streamlines the process of car usage by giving you a single monthly price that includes a vehicle for six or 12 months, insurance coverage, registration, maintenance, and roadside assistance.

Final thoughts

Car insurance premiums are important for not only you and your vehicle, but also others on the road. Of course, because of the variation across premiums, selecting the right plan may require significant consideration. Some may even wonder if there is a better solution for their needs.

A FINN subscription streamlines the process of car usage by giving you a single monthly price that includes a vehicle for six or 12 months, insurance coverage, registration, maintenance, and roadside assistance.

You may also like

Can You Pause Car Insurance?

Learn about the possibility of pausing car insurance when you're not driving and explore alternatives to save money. Understand the steps to pause and reinstate your policy, as well as the pros and cons of this option. Plus, consider an alternative for periods when you don't need long-term coverage.

Is Insurance on a Leased Car More Expensive?

Leasing a car brings with it additional expenses. Is insurance on a leased car more expensive? Keep reading to find out more about leased car insurance rates.

Is Insurance Included in a Leased Car?

You’ve got all the leasing details worked out in your head, and you’re ready to start looking for lease deals. But have you thought about insuring your newly leased car? Read on to learn about what type of coverage you need to lease a car.